If you search online for the “best” age to take Social Security, you’ll find no shortage of confident answers.

Some say taking it at 62 is a mistake.

Others insist waiting until 70 is the only smart move.

There are charts, calculators, breakeven points, and experts who speak as if everyone’s life follows the same script.

But for most people, the decision isn’t nearly that clean.

The truth is, the right age to take Social Security depends on one thing that rarely makes it into the conversation:

How much longer you can realistically keep going.

Not on paper — but in real life.

Yes, the Math Matters — But It’s Only Part of the Story

Let’s acknowledge the basics, because they’re true.

If you take Social Security early, your monthly benefit is permanently reduced.

If you wait, your benefit grows.

That part is straightforward, and every calculator on the internet can show you the numbers.

But what those calculators don’t ask is this:

What does continuing to work actually cost you?

Because that cost doesn’t show up in a spreadsheet.

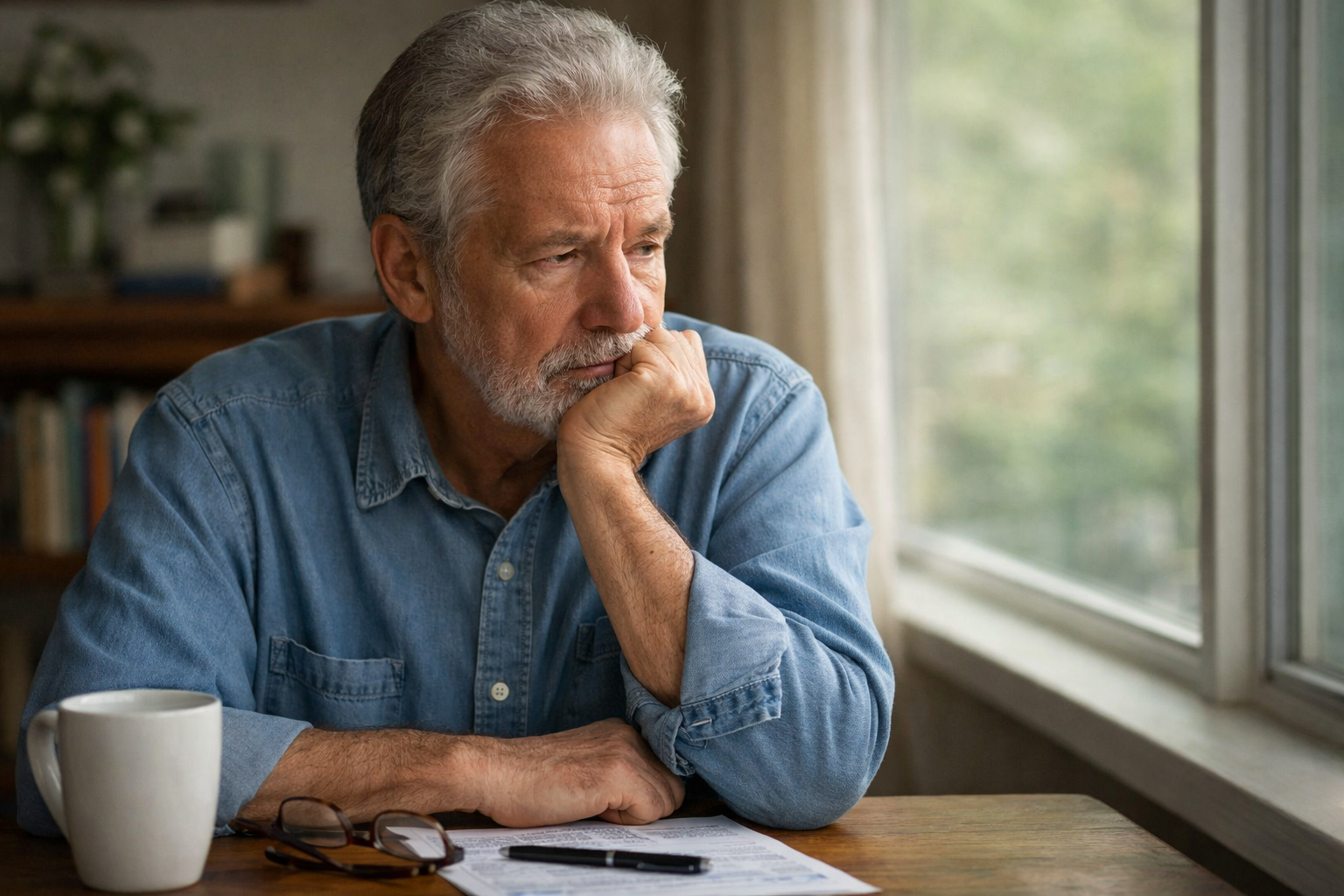

What the Calculators Don’t Measure

Most Social Security advice assumes one thing: that you can simply keep working until the numbers look better.

But real life isn’t that simple.

Calculators don’t measure chronic stress, physical wear and tear, mental exhaustion, job loss, or the slow realization that you’re running out of energy.

For many retirees — especially those who have spent years living alone in retirement, as I wrote about in The Power of Solitude: How Living Alone Changed Everything — prolonged stress doesn’t fade when the workday ends. Sometimes, the quiet makes it more obvious how depleted you really are.

They don’t measure how it feels to wake up already tired, or how much effort it takes just to get through another workweek.

Why People Take Social Security “Too Early”

There’s a narrative that people who take Social Security early are impatient or financially uninformed.

That’s rarely true.

Most people who claim early do it for practical, human reasons.

They’re burned out.

Their health isn’t what it used to be.

Their job disappeared — or changed into something they can’t tolerate anymore.

They’re caring for a spouse or family member.

Or they’ve reached a point where work is taking more than it’s giving.

In many cases, the decision isn’t about maximizing income — it’s about whether they can realistically live on Social Security, something I’ve spoken about candidly in Here’s How I’m Making It Work on Social Security (Alone).

The Real Question Isn’t “What Age Is Best?”

The question most people should be asking isn’t:

What age maximizes Social Security?

It’s this:

What am I giving up by continuing to work?

For some, the answer is: not much.

They enjoy their job. They’re healthy. They have flexibility.

For others, the cost is high — physically, mentally, emotionally.

And that cost compounds over time.

When Waiting Makes Sense — And When It Doesn’t

Waiting to take Social Security can absolutely make sense.

If you’re healthy.

If you like your work.

If your job gives you flexibility and peace of mind.

If you’re not sacrificing your well-being just to squeeze out a larger check later.

But waiting doesn’t make sense if every year feels heavier than the last — especially if you’ve reached a stage of life where letting go of constant optimization brings more relief than regret, something I explored in The Unexpected Joys of Not Caring After 60.

The Tradeoff Nobody Likes to Admit

Here’s the uncomfortable part that most advice avoids.

Yes, taking Social Security early comes with a permanent reduction.

And yes, some people accept that knowingly.

Not because they don’t understand the math — but because they understand themselves.

They choose less money in exchange for peace.

Predictability instead of pressure.

Time over optimization.

That doesn’t mean it’s the right choice for everyone.

It just means it isn’t a foolish one.

The Pressure to “Get It Right”

There’s an unspoken pressure around this decision.

People feel judged — by experts, by family, by strangers online — as if there’s a single correct answer.

But retirement has a way of reminding us that no two retirements look the same, a theme I’ve returned to before in Want to Walk in Retiree Shoes? Decisions only make sense in context.

Social Security was designed as a safety net, not a performance test.

It was never meant to be optimized at the expense of your health or sanity.

What Actually Matters

When deciding when to take Social Security, the questions that matter most aren’t always financial.

They’re personal.

Can you live on the benefit you’ll receive?

Will taking it reduce stress or increase it?

Are you choosing based on fear — or clarity?

Are you buying yourself relief, or borrowing trouble?

There’s no calculator for those questions.

Only honesty.

There Is No Perfect Age

There is no perfect age to take Social Security.

There’s only a decision that reflects your health, your work reality, your finances, and your capacity to keep going.

Some people wait — and it’s the right choice for them.

Some people don’t — and it’s the right choice for them too.

The mistake isn’t taking it early or late.

The mistake is pretending everyone’s life follows the same script.

Final Thought

The best Social Security decision isn’t the one that looks smartest on paper.

It’s the one that balances money with the life you’re actually living.

And sometimes, choosing peace over optimization isn’t a failure of planning —

it’s an act of self-respect.